Everything You Want to Know About Insurance Right Now…and Some Things You Don’t

The insurance market in 2022 was anything but boring.

This was the year that many loyal clients felt the impact of non-renewals more significantly than any other year since our Thomas Fire and Debris Flow of 2018. Many clients of Chubb and AIG Private client -- who often enjoyed very comprehensive coverage and reasonable premiums for decades -- received cancellation letters in 2022. By definition, many of these clients were considered to be in high-value homes which hadn’t historically been difficult to insure. More on that later (see ‘Why is insurance so expensive?’). With the changing fire market in California, however, many of these same clients are also in locations that insurance carriers now consider to be a high fire risk.

Other clients who purchased properties in 2020 or 2021 with the hope that insurance costs might stabilize in the near future have yet to feel much relief. Insurance costs in 2022 remained higher than years prior because of market pressures in California, the US as a whole, and internationally. Insurance costs and potential fire risk continued to be at the forefront of clients’ minds when looking to purchase a property in 2022. Though this was almost unheard of just 5 years ago, we expect this to continue in 2023. While we’re happy to see insurance no longer seems to be an afterthought when making a large purchasing decision like investing in a property, we do wish it was top of mind for other reasons as opposed to cost or ability to get it.

As we look ahead to 2023, we do expect the home insurance market in California as a whole to be remarkably similar to the past 12 months, with many of the same challenges. While we do expect more insurance carriers will enter our market (yay!), we also expect premiums to align with those we’ve seen in 2022 (boo).

Is there any good news?

Yes.

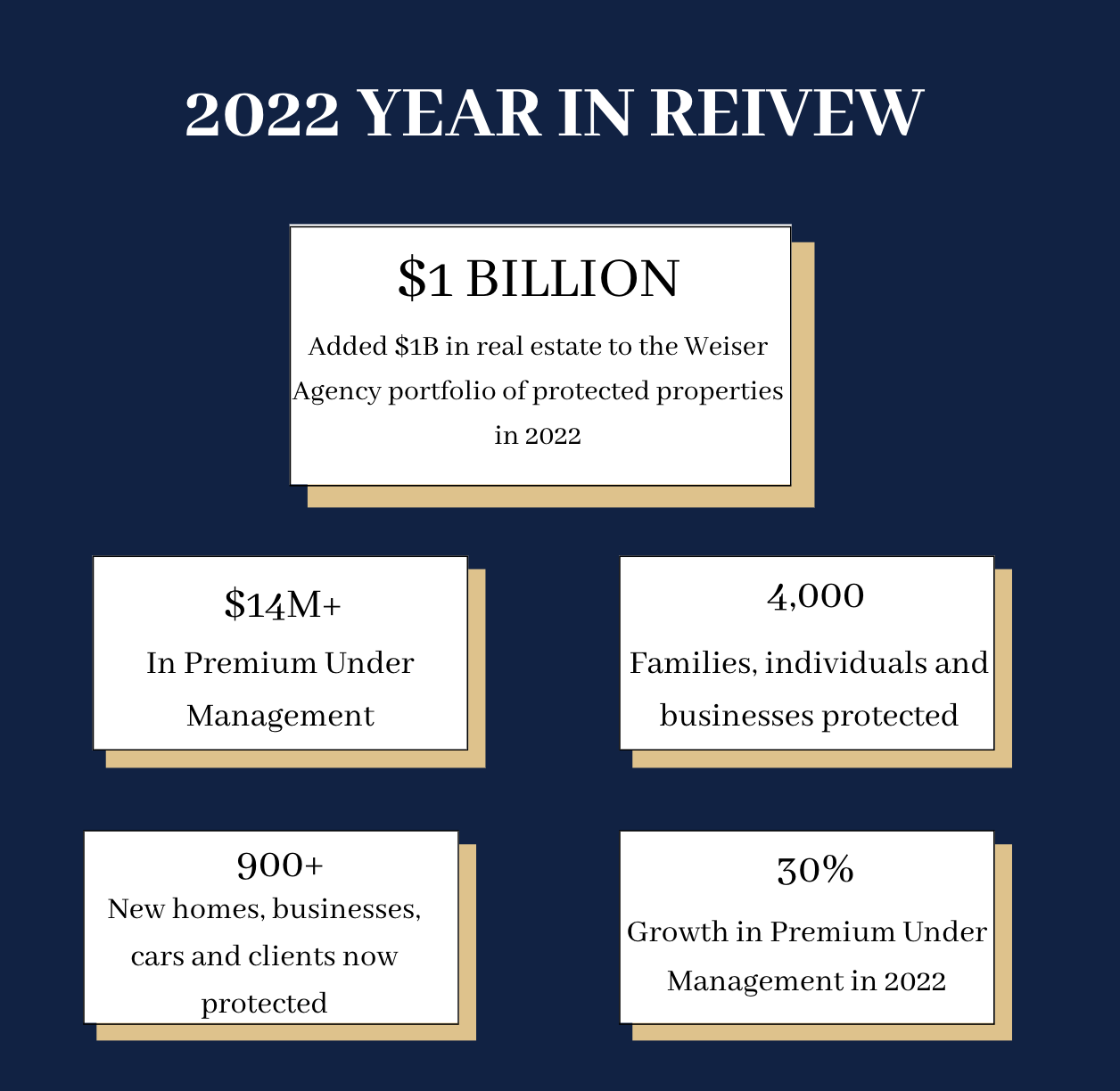

We understand our clients are continuing to pay more for insurance now than they have in years past. Though we cannot directly control the cost of insurance itself, we can control our ability to invest more fully in our local team and systems to better support our clients. And we’ve done just that.

In 2022, we hired a Claims Concierge with 20+ years of industry experience. While all of our team members are experienced in guiding clients through claims, this investment allows us to even more fully deliver on our promise to our clients when they need us the most.

We also expanded our in-house Personal Lines Underwriting team by bringing on more experienced team members. We know insurance options can be limited and hard to find. We pride ourselves in our ability to get creative even in the face of that and problem-solve for our clients. Gone are the days when insurance companies could put an address into a system and spit out a quote. Or at least they should be. Those systems don’t know how to accurately compute reconstruction costs here and certainly don’t know how to design a custom policy for a client’s specific priorities and future goals. We know your home, property, and investments are unique, and they deserve the detailed approach you can get from a thorough review with our in-house underwriting team.

Beyond our investments in our team, we have also invested in proprietary software that allows us to more directly communicate with and contact clients in the event of a disaster. Some clients may have experienced a bit of this during our recent storm on January 9. While we hope to never need to use this system, it does allow our team to quickly identify clients who could potentially be impacted by a significant event and contact them in real-time. In doing so, we hope to be able to provide just a little peace of mind during a time of uncertainty.

My home’s not in a high-fire area. Why is insurance still so expensive?

The cost of insurance and our ability to get quality coverage here locally is impacted by the cost of insurance throughout California as a whole. Chubb and AIG Private Client, for example, paid out significant claims in the past 5 years throughout all of the sunshine state and are, therefore, more hesitant to offer coverage in any part of it. This has put pressure on other insurance carriers to provide coverage to clients that Chubb and AIG canceled. Throughout 2022, these other carriers became oversaturated as they put on more households. Because of this, we saw fewer and fewer insurance carriers agree to offer coverage in the later part of 2022, and those that did continue to offer coverage were often more restrictive.

In addition to concerns about oversaturation, our insurance carriers in Montecito, Santa Barbara, and anywhere in California are impacted by global events. A hurricane in Florida or flooding in Australia can increase the cost of insurance globally. Insurance companies that protect our high-end properties here in Montecito and Santa Barbara often get insurance of their own on those properties (aka: re-insurance). If a re-insurance company needs to pay out a significant amount in claims due to that event in Florida or Australia, those costs can be passed down to the insurance companies here locally. When re-insurance becomes more expensive due to global events, the cost of the insurance to our clients here locally also goes up.

Is Car Insurance Looking Any Better?

Not yet. As the cost of car parts has increased significantly due to global supply shortages, so too has the cost of repairs. Typically, insurance carriers would look to offset the increased cost of repairs and claims by modestly increasing the cost of car insurance. In 2020 and 2021, however, the California Department of Insurance prohibited insurance carriers from doing so. The idea was to keep financial pressures on consumers low during the pandemic when many were working from home or driving significantly less. This, compounded by an increase in bodily injury claims as well as an increase in medical costs, has led to a change in how insurance companies manage risk.

Very well intended; however, we’re now seeing the impact of it in other ways as insurance companies are looking at these costs. We’ve already seen some companies stop providing monthly payment plan options (requiring only annual or semi-annual payments). We’ve also seen car insurance carriers require a 5–15-day delay between when a client wants to start a car insurance policy and when the coverage actually begins. We suspect we’ll likely see more of this in 2023.

Commercial Insurance?

The same factors that impact the home insurance market – oversaturation, limited providers, fire risk, etc. – also plague the commercial property market. Though there does seem to be a bit of a lag. Thus, we expect the commercial property insurance market of 2023 to mirror the residential insurance market of 2022.

A Look Ahead and A Look Back

While we do expect the insurance market to remain challenged in 2023, we are confident in our team’s ability to find the best solutions for all our clients. We will continue the investments we’ve already made in our team and our systems to allow us to continue to provide creative solutions even in a difficult market. Our Weiser Agency team is better equipped now than ever before to help our clients get the most from their home, business, and life insurance both now and in the future.